Ubuntu Linux How to Clone a Disk

Research Links

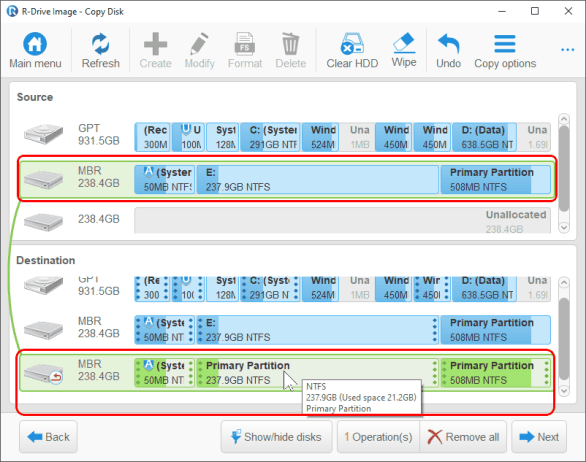

To clone a disk in Ubuntu, the most common methods involve booting from a Live USB and using tools like dd (block-level copy) for a direct clone or Clonezilla / Gnome Disks for a more user-friendly, partition-aware process, ensuring the target disk is equal or larger, and being extremely careful with device names (/dev/sda, /dev/sdb) to avoid data loss.

Yes, you can easily clone from one external disk to another in Ubuntu using command-line tools like dd or rsync, or dedicated graphical tools like Clonezilla, ensuring you identify source/target drives correctly to avoid data loss, often by booting from a Live USB for system drives. Always double-check drive identifiers and consider post-clone steps like updating UUIDs if you plan to use both drives simultaneously or move the cloned drive to a new system.