Private: Precious Metals Roundup Week Ending 2-7-2026

YT: CARNAGE in the SILVER Market – Which Stocks Are on Sale and When to Buy?

- Several stocks recommended: Used: Youtube video summarizer

Mining Sector: Stocks, Equity Opportunities, and Market Sentiment

- John Fenick and Don Durret highlight mispricing and misunderstanding in silver and gold mining equities, especially juniors.

- Key silver mining stocks recommended for investment or watchlist include:

John Fenick names:

| Company | Ticker(s) | Key Attributes |

|---|---|---|

| Aftermath Silver | AGF (US), AG (CA) | 800+ million silver equivalent ounces; projects in Chile & Peru |

| Black Rock Silver | BKRRF (US), BRC (CA) | Near-production; Nevada-based; 108 million silver equivalent ounces |

| Exelon | EXNRF (US), EXN (CA) | New project from Buenaventura; production restart expected summer 2026 |

| Kore Mining | Not specified | Silver producer |

| Hecla Mining | Not specified | Silver producer; impacted by permitting delays |

| Pan-American Silver | Not specified | Established silver producer |

| First Majestic | Not specified | Major silver producer |

| Endeavour Silver | Not specified | Established silver producer |

| Aino Silver | Not specified | Smaller producer (~3.5 million ounces/year), growing |

- Developers to watch include: Go Gold Discovery (Cordero Project), Vizsla, Silvertorm, and Abra Silver.

Don Durret Names

| Company | Location | Notes |

|---|---|---|

| Paramount Gold | Oregon, Nevada | First gold mine in Oregon permitted in decades |

| PTX Metals | Ontario, Canada | Engaging government for faster development |

| Lontan Gold, P2 Gold, Western Resources | Nevada | Open-pit gold projects likely benefiting from fast-track |

| Hecla Mining | Montana | Permitting difficulties but improving environment |

| Revival | Utah, Idaho | Multiple US projects poised to benefit |

@GreySkyBlue @Emil Buchbinder I am going around in circles. :nerd_face:

GAI: who holds the silver for the slv?

JPMorgan Chase Bank acts as the primary custodian for the physical silver bullion held by the iShares Silver Trust (SLV), storing it in their secure vaults in London. The trust sponsored by a subsidiary of BlackRock, is designed to reflect the performance of the price of silver, with the silver being held on behalf of the trust.

- Custodian: JPMorgan Chase Bank N.A. stores the vast majority of the physical silver.

- Trustee: The Bank of New York Mellon acts as the trustee.

- Sponsor: iShares Delaware Trust Sponsor LLC, a BlackRock company.

- Storage Location: Primarily London, England, in the vaults of the custodian.

The silver held is in the form of London Good Delivery bars, which meet strict purity and weight standards. The holdings are subject to regular audits.

His explanation of the crash follows. Mostly blames it on leverage ( margin? ). Refers to same document as previous tweet.

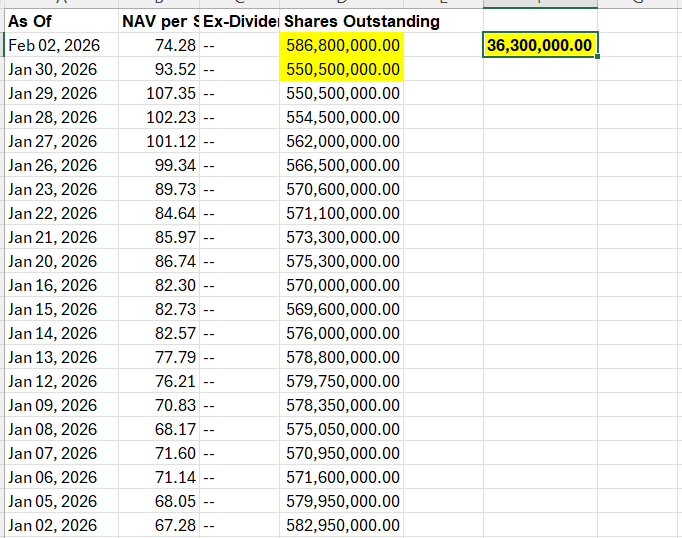

X: bob coleman: @profitsplusid: SLV ETF ALERT >> The largest one day drop in Silver's history and the next day saw 36.3 million shares created or 32.9 million ounces deposited into the fund. The largest amount of silver held by SLV so far in 2026 and 2025.

YT: URGENT! Did Someone BIG Crash The SILVER Price? (Here's Why) | Gary Savage

"Friday was a rescue for the short positions…. The final move will be all the much higher, my prediction is $250 will be a piece of cake and $500 is a possibility".

Billionaire Eric Sprott invested over $225M since June 2025 and now owns 41% of Hycroft while continuing to buy.

https://finance.yahoo.com/news/investors-lose-mind-hycroft-runs-192739222.html

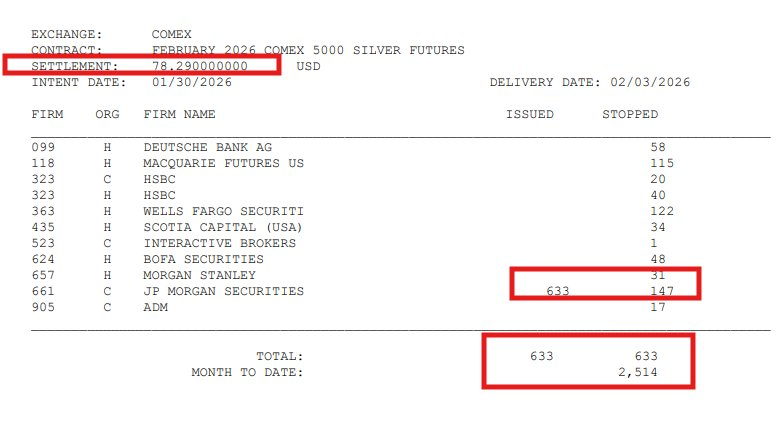

BREAKING: 2,514 Silver Feb26 futures contracts have been issued delivery notices and all accepted for delivery already at the Comex.

That’s 12.5m oz right away in a usually low deliveries month Fun fact: JPM was the SHORT bank that issued ALL the 633 notices on Friday

If you look carefully into the latest Comex report, $JPM closed its silver shorts EXACTLY at the very bottom of the price crash and from there it all started to come back up. This isn’t coincidence This isn’t conspiracy theory. This is the proof the whole Friday crash was planned

Here is the full explanation of how the biggest exploit in the history of precious metals likely unfolded ????????

Comex futures price settlement at the Comex is based on a VWAP between 13:24 to 13:25EST

LBMA price settlement instead happens at 12:00 UK time

Most of Silver OTC contracts settle using the LBMA reference and many OTC contracts expire into month end.

On the 30th Jan LBMA silver price benchmark settled at 103.19$ while the Comex Benchmark a few hours later settled at 78.29$.

The following chart (credit @KingKong9888

) is a great representation of how bullion banks hedge and transact in the silver market (both paper and physical).

It is an open secret now how many banks and brokers were under water on their silver positions, gold and other precious metals especially after the rally in January. Beware this flow chart roughly applies to all these metals that all crashed on Friday (not silver alone).

What’s even more remarkable is how precocious metals crashed on Friday in isolation, stocks, bonds and other commodities were totally unaffected. Anyone that understands any basic of macro and markets knows how this is logically wrong.

Let’s add one more piece to the puzzle now: on Friday the OI at the Comex decreased by 8k contracts at the end of the day. Assuming for simplicity the price differential between the LBMA and the Comex as a reference. That means banks were able to extract ~1bn$ gain from their shorts pushing the Comex price through the floor after the LBMA settlement.

Furthermore the $SLV continued trading after the LBMA benchmark settlement creating almost a 20% discount to NAV because of that. Here is the other trick the banks pulled. If you have to settle a lot of physical contracts at the LBMA but you don’t have the metal, because of such a discount to NAV, AP banks could buy $SLV shares in the open market from panic selling investors, tender the shares to claim bars at 103.19$ and make a killing in the process.

Not surprisingly, $SLV shares count increased by ~51m shared from Thursday to Friday according to iShares. Because of the NAV discount banks extracted up to 1.5bn$ of profits exploiting this ETF assuming they bought up all that shares differential and then turned around to claim silver bars at a much higher price for contract settlement purposes (keep an eye on the data on the metals redemption from the ETF).

The last piece of the puzzle is the exploit against Leveraged silver ETFs like $AGQ that have been forced into liquidating a vast number of derivative contracts during the crash. Here brokers made a killing too, but other people here on X already covered this matter well so no need for me to say more.

All in all, it’s fair to estimate how banks and brokers made up to 5bn$ of profits (or lowered their pre existing losses depending on how you look at it) orchestrating one of the biggest price manipulation in the history to abnormally crash the price of silver in a single day. Surely they made more if you consider the same dynamics happened on gold platinum and palladium.

However this left the precious metals market in a massive price dislocation not only between physical and paper, but also across financial products and exchanges.

Trading resumes in less than 24 hours and there is a chance that what’s about to happen is going to be even more historic than Friday’s events because China and India won’t stop buying silver because of the severe industrial shortage they are dealing with.

Vince covers Hartnett flow show: Ready for phase 2 of gold

1-1-2026: Eric Sprott, a ten percent owner, along with 2176423 Ontario Ltd., reported purchasing 200,000 shares of HYCROFT MINING HOLDING CORP(NASDAQ:HYMC) Class A common stock on January 29, 2026. The shares were bought at a price of $45.99, for a total transaction value of $9,198,000.

- Investing.com: Sprott Eric buys Hycroft Mining (HYMC) shares worth 9.19 million another 200,000 shares

As far as I can tell only myself and Michael Oliver understand what is going on in the metals market. I'm sure there are a few others I just haven't seen them.

Metals have completed the first part of the bubble phase of a very mature (26 year) secular bull market. This correction should be recovered quickly. When it does that will bring in the general public, and that is what drives the second part of the bubble phase.

The fact that the corrective phase separating the first part from the second part wasn't allowed to play out naturally just guarantees the final top will be even higher.

Friday's attack to rescue the banks from their short positions has significantly increased the odds that we could see my upper target level of $500, and do so within the next 6-8 months.

The gains made during this first part have been mind blowing, but you haven't seen anything yet.

X: Tracy Shuchart (???????????? ) @chigrl:

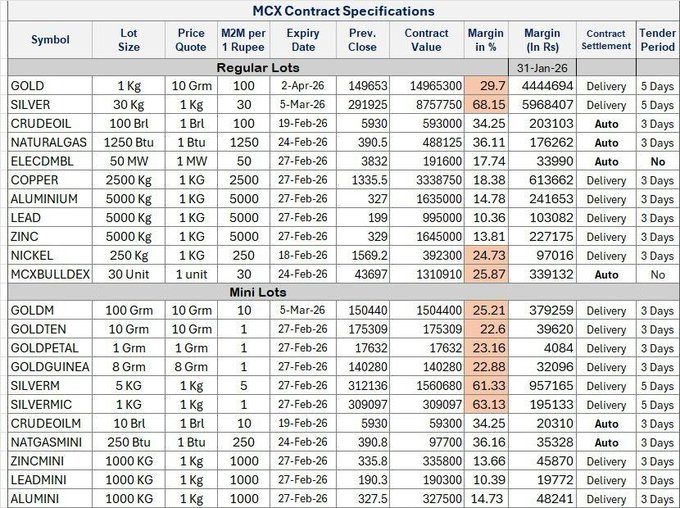

Friday's 25% silver crash wasn't about Warsh or dollar strength. It was margin induced liquidation at record prices while physical fundamentals tightened. The smoking gun: SHFE premiums exploded to 25% above US prices during the selloff, proving physical holders are hoarding while overleveraged paper longs got blown out. CME raised margins to 11% on January 28 (after shifting to percentage based on January 13), forcing specs who went long at $25k margin to suddenly post $66k at $120 silver. Meanwhile China's January 1 export controls are crimping supply and India absorbed 25% of global production in 2025 with inelastic demand. Moving onto JPM's February delivery data showing them issuing 633 contracts at Friday's $78.29 settlement, suggesting large banks covered shorts by buying from forced sellers at the bottom while physical markets refuse to participate at any price. If JPM covered a large short book during the forced liquidation by buying from overleveraged specs at $78-90, they exited near the lows while physical holders in China and India refused to sell at any price, setting up a dangerous rebound dynamic with far less short interest to cap the next move. Just my thoughts. This all speculation until we see the open in Asia.

X: Thiede Investments: @ThiedeInvests:

$HSLV $HSLV.TO Eric Sprott made a gigantic strategic investment of 40 million US dollars in Highlander Silver just last week, when the silver price was rapidly heading towards its cycle high. Why should one of the most renowned commodity billionaires ever invest such a huge sum in a silver mining company at the height of a parabolic rise when he expects a crash and a market high? This investment alone is a clear indicator that he believes in a rising price of silver and secures the best junior mines before the horde wakes up. And this wasn't his only investment in junior gold and silver mining companies during this parabolic rise over the past six weeks. Sprott pumped over $100 million into gold and silver junior mines in December and January alone during the parabolic rise.

X: Lukas Ekwueme: @ekwufinance: Rick Rule: We’re in a bull market – don’t waste it.

Rick Rule: We’re in a bull market – don’t waste it.

– In the 1970s, the gold price fell 3 times by 30% or more

– 1971-1975: Gold increased 6x, from $35 to $200

– In 1975, gold fell from $200 to $100

Everyone shaken out at $100 missed the move to $850 by 1980. “You have to prepare yourself financially and psychologically for 20-50% pullbacks.”

- Podcast mentioned ( forget which one ) that Martin Armstrong said that Europeans are probably afraid of gold / silver confiscation and that they are opting for platinum hoping to side step that.

X: Ankit Prajapati (@AnkitPrjpti) : Damn….60%+ margin requirement for Silver contracts

Producers / near-term producers (his preferred core holdings)

- 120m oz in stock.

- 450m oz pending delivery

Good’ ol classic bankrun. There is no silver left.

Grok AI Detailed Summary of Don Durrant's Weekly Call – January 31, 2026 Don Durrant hosted his regular weekend live video call with ~100 participants (a new high), right after a sharp Friday sell-off in gold & silver.

Market Recap & Near-Term View (very short-term):

- Gold reached ~$5,500 mid-week but closed the week down ~1%. Still +13% in January (started ~$4,300–4,350, ended ~$4,900).

- Silver started January ~$70, ended ~$85.

- Friday's drop was described as a classic “month-end / leverage flush / margin-call / new Fed chair hawk announcement” combination → “perfect storm” but not a macro trend change.

- He repeatedly called it a “nothing burger” and a healthy shake-out of weak leveraged hands (especially China leverage unwinding expected Sunday night / Monday open).

- Expectation: modest further dip likely Monday (tether gold already showing ~$4,824 equivalent → ~$100 off Friday close), possible stabilization / rebound by Wednesday–end of week.

- Longer-term: still very bullish — “we are in a bull market” (gold from ~$2,000 → $5,500 in ~2 years), miners still very early in participation cycle (most quality names still trading low-to-normal multiples, vast majority <10× forward).

Core Macro Thesis (unchanged & emphasized):

- Central driver = unsustainable US debt bubble (now so large it cannot be serviced without perpetual money printing / inflation / eventual reset).

- Dollar reserve / Treasury demand will eventually fail → once recession starts, foreign buying dries up → bond market breaks → dollar loses global hegemony.

- BRICS / new monetary order / gold-backed / commodity-backed trade accelerating the timeline.

- Trump trying everything (tariffs, threats, NATO pressure, etc.) to delay the loss of reserve status → but ultimately insufficient.

- Gold = hedge against that inevitable reset. Silver now behaving as monetary metal above ~$35 → inventory squeeze intensifying (fabricator demand ~700 Moz, mine supply ~800 Moz → investor deficit ~200 Moz → price volatility).

Miner Valuation & Opportunity Set:

- Miners have not yet participated meaningfully despite gold +150%+ in 2 years.

- Most quality names still trade low/normal multiples (<10× forward).

- Expects eventual “frothiness” (multiples expanding dramatically) before the cycle ends.

- Very focused on future free cash flow at higher metal prices + multiple expansion, not current in-ground resource multiples.

Stocks he explicitly said he likes / added to / remains bullish on (from newsletter & call):

Producers / near-term producers (his preferred core holdings)

- Moneros Alamos (mid-tier, trading <2× forward, only producer on his highlighted list)

- Talisker (growing production, very happy with progress)

- Jaguar (ramping, very cheap forward multiple ~1–3×, loves the CEO & plan)

- West Red Lake Gold (added recently, Canadian producer)

- Pan American Silver, Hecla, Coeur (elite silver producers — “own them all”)

Advanced developers / construction or near-construction (2–3 years window emphasis)

- 1911 Gold

- Cassiar (pivoting to development)

- Gallion Gold (deposit now ≥2 Moz, permit expected soon) [Ed: ??? Not sure what this one is – maybe Gogold Resources?]

- GR Silver (permitted 600 tpd mill, wants 2,000 tpd)

- Lahoatan

- NexGold (in construction)

- Norsemont (good progress)

- O Cisco (in construction?)

- Scottie Resources (≈2 years out)

- Silver Storm (very impressed with CEO & San Diego potential — “getting no value”)

- Silver Tiger (doing great)

- SilverX (recently turned more bullish after PEA, despite dilution concerns)

- Tutor Gold

Smaller / higher-risk but asymmetric upside mentions

- Sonoro Gold (very cheap, low-capex restart, strong insiders, underweight → considering adding)

- Borealis (similar restart profile, underweight)

- Blackrock Silver (now building → likes it again)

- Highlander Silver (loves CEO & plan, construction next year)

- Perpetual (close to permitted, funded via Ex-Im Bank?)

Avoid / very cautious

- Mexico overall risk up sharply after Vizla disappearance (Sinaloa cartel suspected) → prefers Canada / Australia.

- South Africa, West Africa pure-plays (political/security risk).

- Small deposits (<2 Moz gold) unless very high-grade or exceptional jurisdiction/insiders.

- Pure exploration drill stories (except rare asymmetric high-conviction bets like Power Metallic PGE play).

Portfolio & Selling Guidance:

- Goal = roughly double portfolio twice (~3× total return from here) → expects to achieve before ~$7,000 gold.

- Plans to start lightening when miners become “frothy” (high multiples) and/or silver hits extreme targets (e.g. $200).

- Willing to sell half positions in big winners (e.g. Hecla) on extreme moves.

- Expects full exit by ~$7,000 gold (conservative estimate).

- Comfortable rotating paper silver/gold (PSLV, PHYS, SLV) → miners while leverage still favors equities.

Bottom line investment takeaway from the call Don views the Friday sell-off as healthy, temporary, and irrelevant to the multi-year bull thesis. He remains aggressively bullish on gold & especially silver miners — particularly producers and near-term developers in safe jurisdictions — because:

- macro driver (US debt / dollar reset) is still intensifying

- miners still very cheap relative to metal prices

- a fear-trade / Wall Street inflow phase still lies ahead (second half 2026 likely strongest)

His bias = stay overweight quality producers + near-construction developers, buy dips (including Monday if it occurs), rotate out of paper metal into equities, and prepare to lighten when frothiness finally appears (likely $6,000–7,000 gold range). He expects volatility but considers the long-term trend decisively higher — “buy the dip” mentality strongly reiterated.

Hzmqq3sg

0 Comments