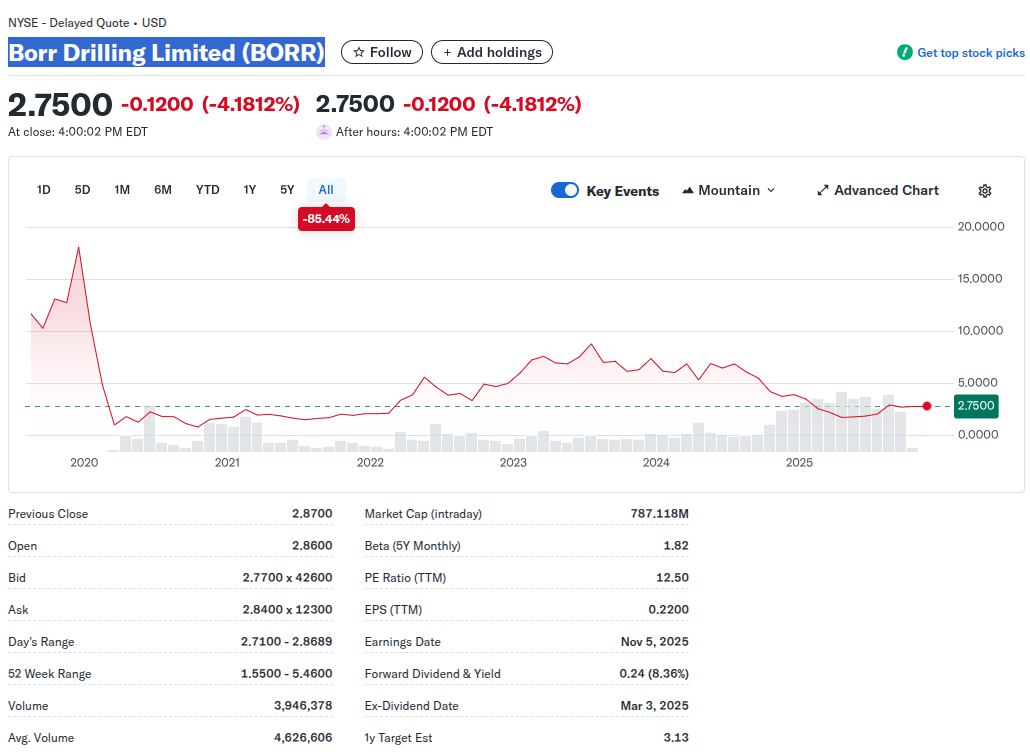

Stocks: Borr Drilling Limited BORR Offshore Drilling

Notes

- 8% Dividend

Research Links

Summary

Offshore is shifting toward dense, near-shore programs led by national oil companies across the Middle East and Asia. Budgets run for years, and the rigs doing most of the work are jack-ups; fast to move, quick to drill, built for repeat campaigns. With limited new supply and tight schedules, operators are prioritizing reliability and continuity.

Borr Drilling is set up for this. It runs a young, modern jack-up fleet in the basins that matter; Saudi Arabia, the UAE, Qatar, Southeast Asia, Mexico, and West Africa; for major state operators. Contracts are moving to better terms, gaps between jobs are small, and debt is coming down. This note explains what that means for cash and value, and what to watch next.

1.1 Why the outlook is strong

Day-rates have doubled. Premium rigs now earn $130–150k/day, compared with $70–80k/day just three years ago.

Utilization is tight. Roughly 91% of modern rigs are working, near full levels for this market.

Little new supply. Only about 11 rigs are under construction worldwide (~2.5% of the fleet), meaning today’s shortage won’t be solved quickly.

Long-term programs. Middle Eastern and Asian oil companies are already extending drilling commitments well into the late 2020s.

1.2 Where the earnings come from

Investors often look at BORR’s backlog and assume the growth story is limited. But many rigs are still finishing older contracts signed at much lower rates. As these contracts roll off, they are reset to today’s higher levels, often close to double.

This means its cash flow is set to rise quarter by quarter without adding a single new rig. In the meantime, the company has been improving its balance sheet: in Q2 it repaid about $67M of debt and added around $200M in liquidity. Less financial pressure means more of the new cash flow will reach shareholders.