Research Links

Notes:

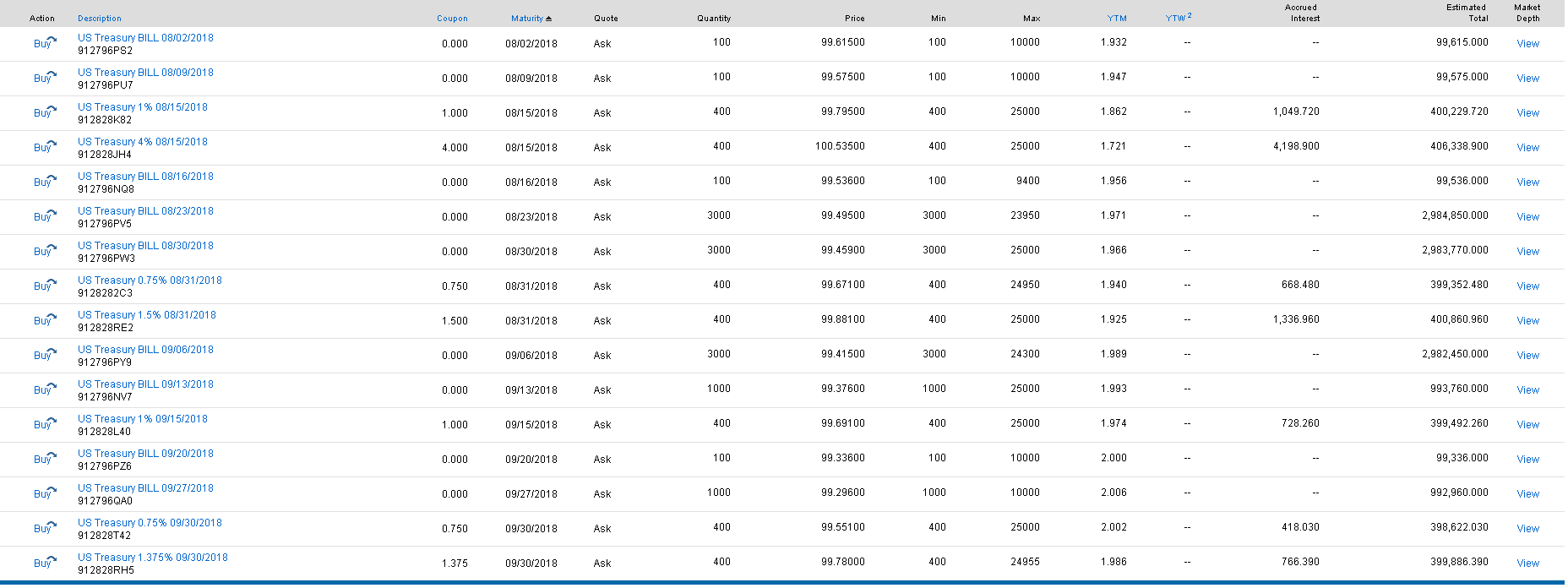

- Income from bonds issued by the federal government and its agencies, including Treasury securities, is generally exempt from state and local taxes.

- Income from bonds issued by state, city, and local governments (municipal bonds, or munis) is generally free from federal taxes. You will, however, have to report this income when filing your taxes. Municipal bond income is also usually free from state tax in the state where the bond was issued. See 2.

0 Comments